FRANCE VAT SERVICES

VAT Registration in France

VAT registration in France threshold is 35,000 EUR. Accordingly, sellers from other EU countries have to register in France. The business trading France and turnover more than 35,000 EUR within a calendar year. The business established outside France or inside in France. It is compulsory to the register for VAT in France. Register for French VAT application must be completed and send to Tax Office in France.

What documents required for VAT registration in France?

- VAT registration in France requires completing Form IMP (EU persons) or Form M0 (non EU persons) and the form’s appendix describing the activity to be performed in France.

- Articles of association.

- A copy of the Identity card or passport of the business owner or Shareholders.

- VAT number in EU member state.

- incorporation certificate.

Businesses established outside of the EU. The sellers must include with their applications the “proxy” appointing the fiscal representative.

It generally takes four to six weeks to obtain France VAT and VAT checking.

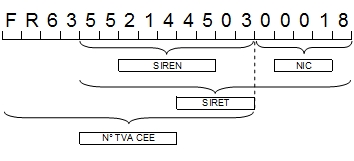

What is a SIREN number?

The SIREN number is your unique French business identification number. This 9 digit number will request for all French administration, when dealing with you, e.g. URSSAF, RSI, Impot, etc. It is proof that you are a fully registered French business. The business name listed on the national business directory répertoire national des entreprises. INSEE (national institute of statistics), will issue your SIREN number.

It is made up of 9 digits, also assigned by INSEE, as part of the company’s registration.

Each number is unique and corresponds to a single company. This number is associated with it for its entire lifetime, from its creation until its dissolution.

For the company, it is essential from an administrative point of view. Indeed, it is his formal identifier, in the same way as an identity card.

Therefore, it must appear on all of the company’s commercial documents. In addition, it serves as a reference for all the steps taken with the administrative authorities.

What is a SIRET number?

Sellers SIRET number will issue, once you have registered your business with the Chambre de Commerce (RCS) for trade. Chambre de Metiers for crafts and manual work or with URSSAF for intellectual services such as translator or website designer. You will receive an Extrait KBIS usually within two weeks of your registration with your SIRET number. For auto entrepreneurs, SIRET number will be on the official letter sent to you by INSEE.

The SIRET number is made up of 14 digits including:

- The first 9 correspond to the SIREN number. They identify the company through the legal person responsible for its management

- The last 5 correspond to the Internal Classification Number (NIC)

It is these last five digits of the SIRET that will differentiate it from the SIREN.

Indeed, the NIC corresponds to the geographical location of each establishment.

Example of SIRET number

Your unique SIRET number should look like RCS PARIS 453 983 245, if you are a limited company or are in a trading activity (commercant) . RCS stands for Registre du Commerce et des Societes, i.e. registration via the Chambre du Commerce et de l’Industrie. For crafts and manual activities (artisans) registering with Chambre de Metiers, your SIRET number will look like RC NANTES 234 987 456.

What is EORI Number in France?

The registration process for the EORI application in France is quite simple. First of all, French economic operators do not have to ask for an EORI number. They already are in the SIRENE database of the French customs authorities. The EORI number will base on the SIRET number. European economic operators must request an EORI number with the French authorities. If they are not in SIRENE database. While economic operators from non-EU member states also have the possibility to register for EORI in France. If this is the first EU country they have to go through customs formalities.

VAT returns in France

France VAT registration certificate will say France VAT return period depends on the taxable person’s turnover. The periodicity of VAT (locally called Taxe sur la valeur ajoutée (TVA) is as follows:

Monthly VAT returns in France are due Set by admin between 15th and 24th of following month.

Quarterly VAT returns in France are due Set by admin between 15th and 24th of month following quarter. Simplified regime or no return, depending on turnover and output VAT due in the previous year (< 4000 EUR).

The normal regime (régime réel normal) file returns monthly. There are two categories of taxpayer that must follow the normal regime:

- Companies whose turnover exceeds EUR 788,000 (goods) or EUR 238,000 (services).

- Another reason, output VAT due exceeded EUR 15,000 the preceding year.

- The simplified regime (régime réel sim- plifié) file returns quarterly and annually. These are two categories of companies that can follow the simplified regime:

- The turnover is between EUR82,800 and EUR788,000 (goods) or between EUR33,100 and EUR238,000 (services), and whose output VAT due the previous year was less than EUR15,000.

- Companies whose turnover exceeds EUR788,000 (goods) or EUR238,000 (services). Whose total output VAT due during the previous calendar year did not exceed EUR4,000.

- Business that are not required to file a VAT return are those whose turnover is less than EUR82,800 (goods) or EUR33,100 (services).

VAT payment in France

For French and non-EU companies, monthly VAT returns and payment are due between the 15th and the 24th day of the month following the end of the return period. The due date depends on several factors including the type of legal entity involved and where the taxable person is established. For EU entities, monthly or quarterly VAT returns are due on the 19th day of the month following the end of the return period.

What is Import VAT refunds in France?

If your non-French company does not carry out transactions that are liable for VAT in France. It may under certain conditions to refund VAT connected with business expenses incurred in France. The customs declaration is usually handled by an appointed freight forwarder. They pay import duty and taxes on behalf of importer. It is worth noting that the payment of import VAT can be waived, when the foreign importer has a VAT number in France. Since importer can use the import VAT postpone scheme applicable to all VAT registered companies since 1, 2022. When a DDP terms (Delivered Duty Paid) is use for the shipment in France. The freight forwarder agent will generally pay in advance for import duty and VAT amount. France customs will send the invoice to the shipper. The letter can reclaim import VAT incurred in France, if certain conditions are fulfilled.

All the following conditions have to fulfil before VAT refund:

- The overseas company will have the importer of record (IOR). To read more on the IOR requirements.

- The overseas business applying for import VAT refund in France is a taxable person in the company of incorporation.

- The customers in France will have VAT number in France. If you clients are individuals, you can appoint an IOSS intermediary for import VAT relief on low value consignments.

- The VAT refund amount will be at least 200 EUR for non0EU companies and 400 EUR for EU companies.

New conditions for filing VAT refund claims and supporting documents

Since 1 July 2021, VAT refund claims filed by tax representatives on behalf of taxable persons established in a country outside the EU must be submitted online.

Supporting documents (bank details, invoices and importation documents when the taxable amount is €1,000 or more or €250 for fuel expenses) must be sent electronically in support of claims.

Online filing of VAT refund claims pursuant to the Thirteenth European Directive has been available since 1 July 2021.

If the tax representative already has a professional account, the service will be accessible from the secure messaging system in their account on impots.gouv.fr.

- Messagerie (Messaging system)

- Ecrire(Write)

- TVA et taxes annexes (VAT and related taxes)

- Demande de remboursement de TVA par un assujetti établi dans un pays hors Union Européenne (13ème directive 86-560-CEE, art. 271-V-d du CGI)(VAT refund claim by a taxable person not established in Community territory (Thirteenth Council Directive 86/560/EEC, Art. 271-V-d of the French General Tax Code).

Deregistration

When ending economic activities, a company has to file a specific form (M4 for non-EU businesses/“declaration de cessation” for EU businesses) within 30 days (extended to 60 days under certain circumstances) following the date of the end of activity. This form must list the transactions performed by the company during this period and the ending date of the activity. Usually, the company will not be allowed to deduct the input VAT due on costs incurred after the date of the end of activity.