European fulfilment network

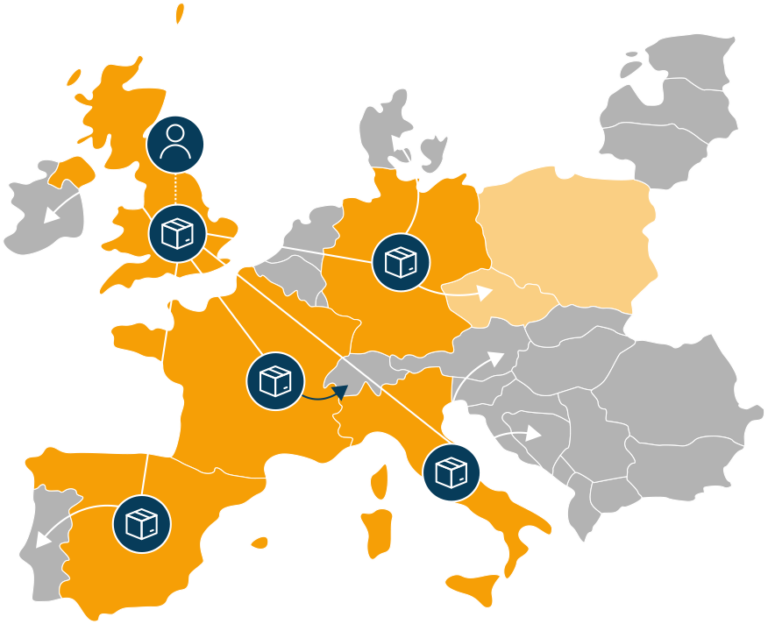

Amazon Pan-European (PAN -EU)

If you want to register for European fulfilment network you will need to have a European sellers account or create one ensure that you add amazon fulfilment. You can view if a product is eligible for pan-EU by clicking on the pan-European stats column of the Pan-European eligible ASIN Report, which is available on the Pan European FBA Inventory page. To sell a product that is available on the amazon catalogue you need to match your existing Amazon standard identification number. However if your product is not already in the amazon catalogue you will have to create a new Amazon standard identification number. You can enable pan EU in your fulfilment by amazon settings in seller central. To enable pan EU FBA you must be eligible to sell in each amazon European marketplace Amazon.co.uk, Amazon.fr, Amazon.de, Amazon.it and Amzon.es. You have to create an active FBA offer for it in each of the five amazon European marketplaces from the same stock pool with identical labelling type. You must enrol an eligible ASIN in the Pan-European FBA programme from the Pan-European FBA Inventory page to start receiving Pan-European FBA benefits on the product.

If you are registering for Pan-EU you will have to register for VAT in 7 countries and you will have to pay local fulfilment fees in all marketplaces. The main benefit of PAN-EU is that you gain access to all of Amazon’s marketplaces in Europe and will also be Prime eligible in all of these countries. You will however need to register for VAT in all of the countries before you switch PAN-EU on, as you will immediately trigger VAT liabilities in all of these countries.

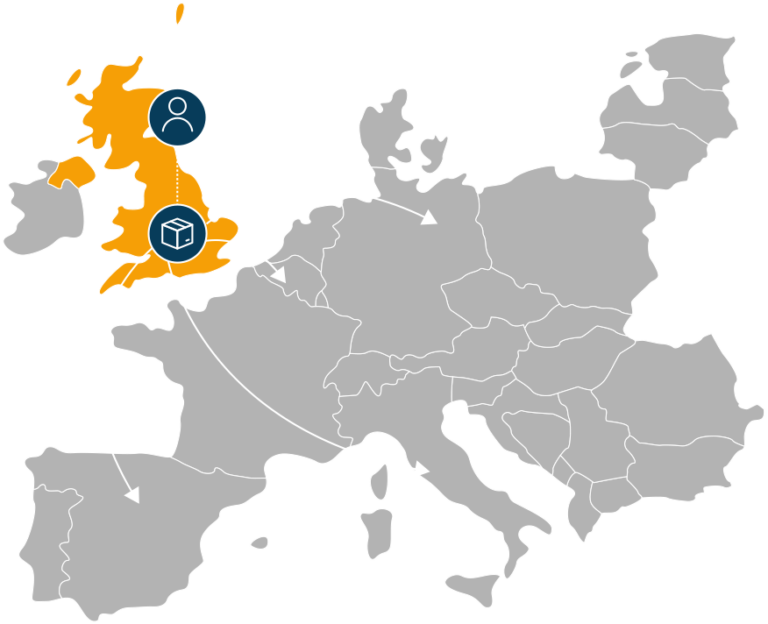

Amazon European fulfilment Network (EFN)

There is no separate registration process to register for the amazon fulfilment centres. If you are already using fulfilment by amazon in one European store. You will automatically able to use the European fulfilment centres in all other Amazon European stores via your Amazon European stores account. When your listings are uploaded to each store with the same SKU and converted to Fulfilled by Amazon on each store.

If you are registering for Amazons European fulfilment centres then you will only need to register for VAT in one country and you will pay local fulfilment fees on domestic orders.

One of the main benefits of trading under Amazon’s European Fulfilment Network, or EFN, you will only need to initially register for VAT in one country. This is the perfect solution for smaller sellers, or for those wanting to test their product in the European marketplaces before expanding throughout the remaining countries.

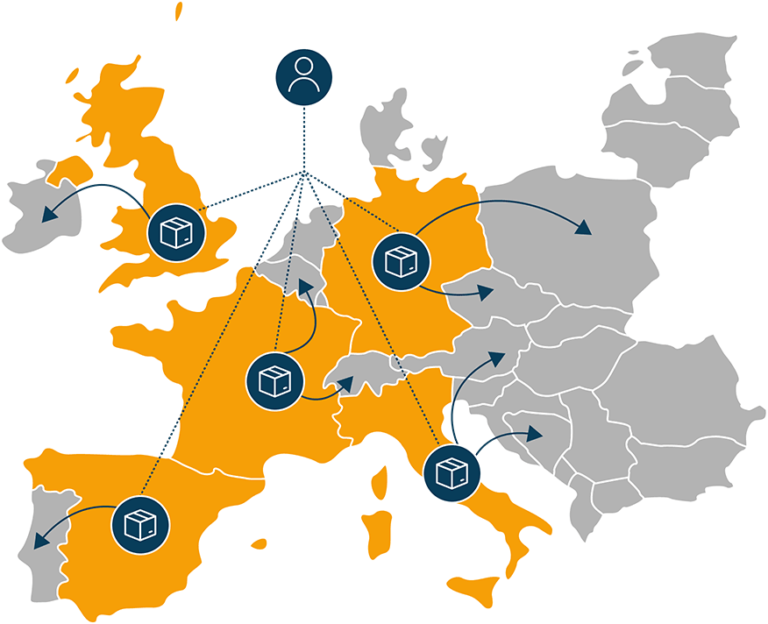

Amazon Multi-Country Inventory (MCI)

Registering for amazon’s multi-country inventory can all be done on the app/website. To register for amazons multi-country inventory you need to go to the shipping workflow and select marketplace destination after that you need to go to the manage FBA inventory page and check the boxes next to the products you wish to send/replenish and click go, to select the countries that you want to enable you click on the drop down box under marketplace destination then in the dispatch to and enable storage in section finally you review the Multi-country Inventory Terms and Conditions and accept these by clicking on the continue to shipping plan button.

Another way in which you can enable the multi-country inventory is by clicking on settings then fulfilment by amazon in the top right of your sellers account you then click the edit button on the right-hand side of the multi-country inventory settings section, tick the checkboxes in all the countries you want to allow inventory to be dispatched to and click update to save your changes

If you are registering for amazons multi-country inventory you will have to register for VAT in 2-5 countries and you will pay local fulfilment fees for sales in the marketplaces where you store your stock.