EIN number for non-US business

EIN Number is a unique nine-digit employer identification number assigned by the Internal Revenue Service (IRS) in the United States to businesses, including corporations, partnerships, and sole proprietorships, as well as certain other entities such as estates, trusts, and non-profit organizations.

For example, in the United Kingdom, non-US businesses can obtain a Unique Taxpayer Reference (UTR) from His Majesty’s Revenue and Customs (HMRC) for tax-related matters. In Canada, non-US businesses can obtain a Business Number (BN) from the Canada Revenue Agency (CRA).

What is EIN?

The EIN serves as a tax identification number for businesses and is used by the IRS to track and identify entities for tax purposes. It is equivalent to a Social Security number for individuals but is used for business entities instead.

The primary purpose of an EIN is to identify a business entity when tax filing, making tax payments, and fulfilling other tax obligations. It is also used for opening business bank accounts, applying for business loans or credit, and engaging in various financial transactions.

How long will it take to get an EIN certificate?

The processing time to obtain an EIN number for non-US business from the Internal Revenue Service (IRS) in the United States can vary depending on the method of application. If you prefer to apply by mail, the processing time for mail applications is usually around 4 weeks.

It’s important to note that these processing times are general estimates and can vary based on various factors, including the volume of applications being processed by the IRS at the time of submission.

Once your application is processed, the IRS will issue an EIN confirmation letter, also known as an EIN certificate. This letter serves as proof of your assigned EIN.

Employer Identification Number (EIN) reporting

EIN reporting refers to the requirement for businesses with an Employer Identification Number (EIN) in the United States to report certain information to the Internal Revenue Service (IRS) and other relevant authorities.

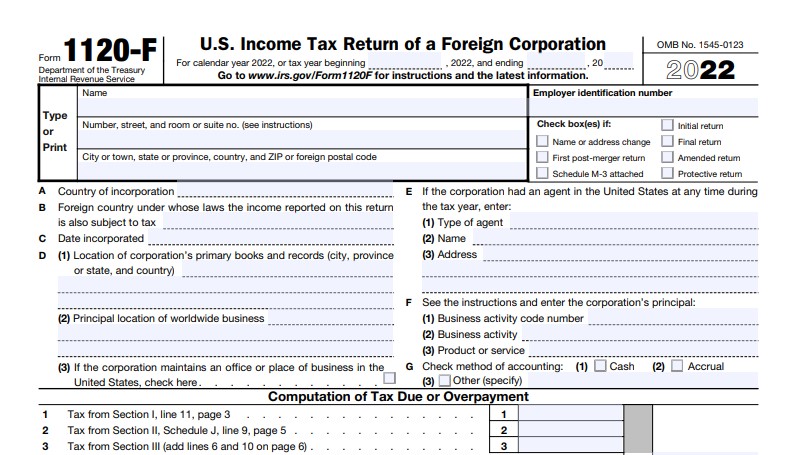

Businesses with an EIN are generally required to file various tax returns with the IRS EIN, depending on their entity type. For example, corporations file Form 1120, partnerships file Form 1065, and sole proprietors report business income on Schedule C of their individual tax return (Form 1040).

Employment Taxes: If your business has employees, you must report and pay employment taxes. This includes filing tax return quarterly or annual tax forms such as Form 941 (Employer’s Quarterly Federal Tax Return) to report wages, withholdings, and employer contributions to Social Security and Medicare taxes.

Who isn’t required to tax filing return?

While the general rule is that businesses are required to tax file return for certain transactions, there are some exceptions and situations where filing information returns may not be necessary. Here are a few scenarios where filing information returns might not be required:

Personal Expenses: Information returns typically pertain to business-related transactions, so if the expenses or payments are personal in nature, there may be no requirement to file information returns. For example, personal payments for personal services, personal rent, or personal interest would not typically require information reporting.

Exempt Payments: Certain types of payments may be exempt from information reporting. For example, wages paid to employees are reported on Form W-2 and are not subject to general information reporting requirements. However, it’s important to note that specific exemptions can vary, and it is advisable to review the guidelines for each type of information return to determine if an exemption applies.

It’s important to consult the specific instructions for each type of information return with tax file number (e.g., Form 1099 series) and the guidance provided by the Internal Revenue Service (IRS) to determine whether your specific situation requires filing of information returns. Additionally, it’s advisable to seek professional advice or consult with a tax expert to ensure compliance with the reporting requirements relevant to your business.

Why is an EIN necessary for sales tax registration?

EIN number for non-US business is required for tax file number in the United States for several reasons:

Identification: An EIN serves as a unique identifier for a business entity. When business number registering for sales tax purposes, the tax authorities use the EIN to associate the business and its sales activities with the correct taxpayer. It helps ensure accurate tracking and reporting of sales tax liabilities.

Communication with Tax Authorities: The EIN allows tax authorities to communicate directly with the business regarding sales tax matters. It provides a standardized and secure way for tax agencies to correspond with businesses, such as sending notifications, updates, or requests for information related to sales tax compliance.

Taxpayer Accountability: The EIN links the business entity to its sales tax obligations. By requiring an EIN for sales tax registration, tax authorities can hold businesses accountable for collecting and remitting the appropriate sales tax amounts. It facilitates monitoring and enforcement of sales tax compliance.

Compliance and Enforcement: Sales tax registration with an EIN helps ensure that businesses comply with sales tax laws and regulations. It enables tax authorities to track registered businesses and verify that they are collecting and remitting the correct amount of sales tax. Non-compliance can lead to penalties, fines, or other enforcement actions.