SA302

SA302 HMRC

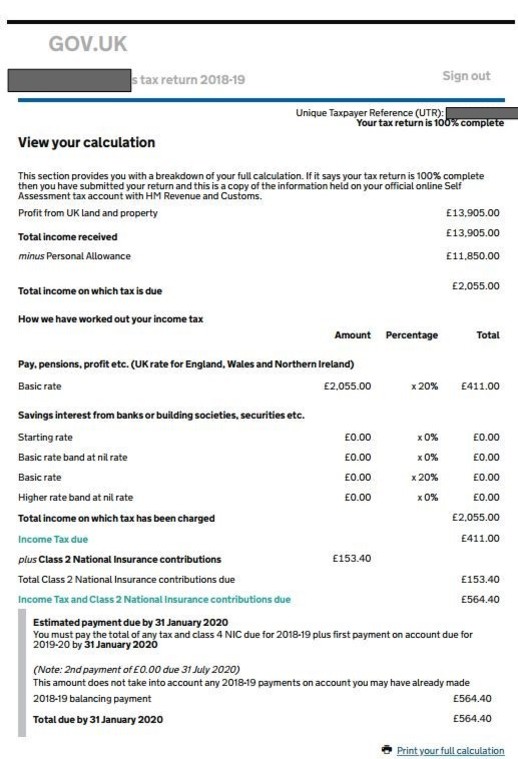

An SA302 is a tax calculation summary document issued by HM Revenue and Customs (HMRC) in the United Kingdom. It provides a detailed breakdown of an individual’s income and the tax they owe or have paid for a specific tax year. It is primarily used for mortgage applications and certain other financial purposes where evidence of income and tax paid is required.

HMRC tax overview

The SA302 is often required by lenders or financial institutions. When individuals apply for a mortgage, especially if they are self-employed, have multiple income sources, or need to prove their income for other reasons.

Format

The SA302 is typically issued in a standard format. It provides a summary of the individual’s total income, taxable income, tax reliefs claimed, and tax payable for the tax year in question.

Self Assessment Tax Return

To get this documents, an individual needs to have filed their Self Assessment tax return for the relevant tax year. The SA302 document is not issued automatically but can be requested from HMRC once the tax return has been processed.

Get SA302

There are two ways to get SA302:

- Online: If you file your Self Assessment tax return online, you can download and print directly from the HMRC online portal.

- By Request HMRC: If you file your tax return on paper or require additional copies. You can request SA302 by contacting HMRC by phone or in writing.

Multiple Income Sources

The SA302 can particularly useful for individuals with multiple income sources. It provides a consolidated view of their income and tax liability.

Accuracy

It is essential to ensure that the information provided the accurate and up-to-date. Any discrepancies or errors in the SA302 could lead to difficulties in obtaining a mortgage or other financial services.

This documents use for specific financial purposes, such as mortgage applications. However, tax-related processes and documentation may evolve over time. HMRC’s procedures may change.

Therefore, if you have any questions related to tax calculations or financial applications. I recommend contacting HMRC or consulting a qualified tax consultant for the most current and accurate information.