Canada GST Services

How to GST registration in Canada?

GST Canada applies to non-residents doing business in Canada. A GST/HST account number is part of a business number (BN). If you don’t have a BN yet, you will receive one when you register for your GST/HST account. A non-resident person is not necessarily considered to be carrying on business in Canada for income tax purposes simply. Because that person is considered to be carrying on business in Canada for GST/HST purposes. Small supplier does not need GST registration. You are no longer a small supplier and you must register for the GST/HST. If your total revenues from taxable supplies are over $30,000 ($50,000 for public service bodies) in a single calendar quarter or over four consecutive calendar quarters.

Even if you do not have to register for the GST/HST because you are a small supplier or because you do not carry on business in Canada. Still you can choose to voluntarily GST registration.

What is a business number?

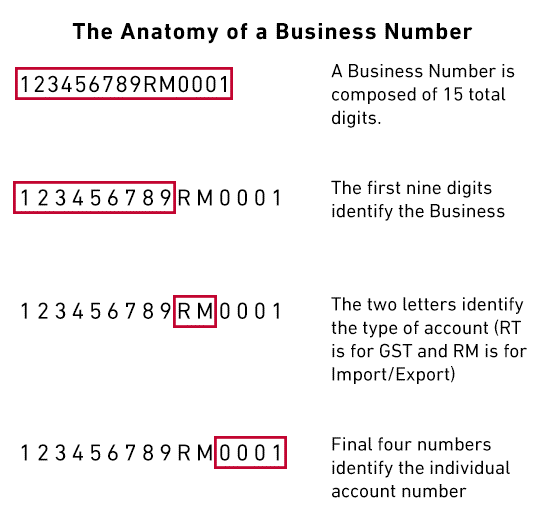

A Business Number (BN) provides businesses with a 15 digit number which the Canadian Revenue Agency (CRA) uses for business accounts. The two important accounts for NRIs are the Goods and Services Tax / Harmonized Sales Tax (GST/HST) program account, and the Import/Export program account.

- Your business will be given a business number by the CRA if you:

- Incorporate it federally

- Register for any CRA program accounts, such as paying the GST (the 5% federal Goods and Services Tax) or HST (harmonized sales tax, which is a combination federal-provincial sales tax paid in the provinces of New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island)

- Register or incorporate it with any of these provinces: Alberta, British Columbia, Manitoba, Nova Scotia, New Brunswick, Ontario, Prince Edward Island, and Saskatchewan

You can use Business registration online to get a business number. You can also register for one or more of the most common Canada Revenue Agency (CRA) program accounts:

- GST/HST program account (RT)

- payroll deductions program account (RP)

- import-export program account (RM)

- corporation income tax program account (RC)

- registered charity program account (RR)

- information returns (RZ)

The business number is supposed to allow for the easy identification of a business at all levels of government. It also prevents confusion of entities that have the same or similar names.

If you just want a business number or to register an RT, RC, RP, RM, RR, or RZ program account, use Business Registration Online instead.

To print a form, go to Form, Request for a Business Number and Certain Program Accounts, or, to order a form, go to Forms and publications.

Fill in Form RC1. Once you have completed the form, mail or fax it to your nearest tax services office or tax centre. To find the appropriate office or centre, go to Find a CRA address.

How does a CRA business number work?

A BN is used by the Canadian government to identify your business. It’s allow you to conduct all your CRA interactions with a single contact. There are two fundamental reasons why you need a BN if you want to be an NRI:

Your BN lets you import into Canada

There is no getting around it: You need a business number if you want to act as an NRI when you ship your goods into Canada. Applying for a BN will let you apply for an Import-Export program account used by the Canadian Government and gives you the option to become the Importer of Record, which is the party responsible for clearing the goods through customs. The Importer of Record is normally the buyer or the seller.

BN lets you register for a GST account

Obtaining a BN does NOT automatically mean you’re registered for a GST account – you need to register for this account separately. While it may not be mandatory to register for GST/HST, there are certain circumstances that would make it mandatory, based on how much revenue you are expecting in a calendar year and if you provide taxable goods and services.

How to submit GST/HST returns?

When you register for the GST/HST, Canadian tax office will give you a reporting period. Reporting periods are GST dates for which you file your GST/HST returns. For each reporting period, you have to prepare and send us a GST/HST return showing the amount of the GST/HST. You charged or collected from your customers and the amount of the payment GST or payable to your suppliers. Your reporting period is determined based on the revenue from your total taxable supplies. It is immediately preceding fiscal year or in all preceding fiscal quarters ending in that fiscal year.

How to pay GST/HST payment?

Canadian tax office can charge penalties and interest on any returns or amounts CRA has not received by the due date. Canadian tax office will hold any GST/HST refund or rebate you are entitled to until Canadian tax office receive all outstanding returns and amounts. If you are a sole proprietor or partnership, your personal income tax refund will also be held. If you are closing a GST/HST account, you must file a final return.

You must file a GST/HST return even if you have:

- no business transactions

- no net tax to remit

When a due date falls on a Saturday, a Sunday, or a public holiday recognized by the Canada Revenue Agency. Your GST payment date is on time if Canadian tax office receive it on the next business day.

GST/HST filing and payment deadlines

The filing deadline will be different depending on your GST/HST filing period.

See filing deadlines for the different filing periods:

- monthly

- quarterly

- annually – (except for individuals with a December 31 fiscal year-end and business income for income tax purposes)

- annually – (individuals with a December 31 fiscal year-end and business income for income tax purposes)

How to process GST Deregister GST?

When you are ready to close (deregister) your GST account, you will need all the following information:

- business number (BN)

- legal name of the business

- cancellation date

- reason for closing the GST/HST account

Fill out Form RC145, Request to Close Business Number Program Accounts.

How do QST registration process work?

No matter where you live or where your online business is based — if you have customers in Quebec, you have to follow Quebecer QST rules. The first step if you have not already registered your business with Revenu Québec is to do so by accessing clicSEQUR-Enterprises on the Entreprise Québec website. You should have on hand your business’ identification number, the name and position of the business’s authorised representative. The name(s) of the persons in charge of online services.

Ultimately, you will receive a QST registration number, which establishes you in the Quebec tax system as a legal business. This number tracks your business through the system: the taxes you pay, the tax credits you receive, plus the Canada tax you charge from customers.

What is LM-1-V form?

Once your business is registered on the Entreprise Québec website, you can complete form LM-1-V online to register for QST and submit it directly to “My Account for Business”.

To complete form LM-1-V you will need to know your Québec Enterprise Number (NEQ) number. Your federal Business Number (both available online), and the names and contact information of directors if you are incorporated. Most of the questions are self explanatory. However, if unsure of an answer reach out to your tax accountant. You will also be asked how often you want to remit GST and QST – monthly, quarterly, or annually. Most businesses prefer annual. However, there are criteria that must be met to qualify for quarterly or annual filing. Your accountant can help you determine your minimum filing requirement.

Once registered for QST you are automatically registered for GST and HST. This is helpful if you conduct business in jurisdictions operating in provinces subject to HST. It’s require to charge HST.

To register by phone, you can call Revenu Québec at 514-873-4692. You should have on hand the same documents needed when registering online.

What is process of British Columbia PST registration?

If you are ecommerce seller to customers in British Columbia, then you might be liable for the region’s Provincial Sales Tax (PST). British Columbia offers an online PST registration for all businesses that are not physically located in the province. Though there’s also the option to register via mail or fax.

First you must register to collect PST using the online portal, eTaxBC. Then you must “enroll for access” to an ongoing eTaxBC account, which is where you will file and pay your tax returns. If you have all the information prepared ahead of time, the registration process will take approximately 15 to 25 minutes.

Here’s what you should have handy before you start:

- Your Canadian federal business number (BN), if you have one. If you don’t have one yet, this process will create one for you!

- If you do already have a BN, a recent copy of a GST return to verify information about your business

- Your passport or other government issued ID

- The amount of your anticipated monthly taxable sales/leases

The 9-step process is mostly straightforward, but there is an extra step for foreign businesses: you must fill out a “country registration questionnaire.”

Your registration can take up to 21 business days to be processed. Once it’s approved, you’ll receive a British Columbia PST number, which will be 11 characters long and is in this format: PST-1234-5678. This is a unique identifier they will use to identify you in the system, and which you’ll need to put on invoices.