Amazon FBA and EU VAT rules

What is Amazon FBA?

Fulfillment by Amazon (FBA) is a service that allows businesses to outsource order fulfillment to Amazon. This takes the burden of sellers and grants them more flexibility in their selling practices. The program allows sellers to ship their merchandise to an Amazon fulfillment center. Where items are stored in Amazon warehouses until they are sold. When an order is placed, Amazon employees physically prepare, package, and ship the product(s). Businesses send products to Amazon fulfillment centers and when a customer makes a purchase. Amazon fulfillment center will pick, pack, and ship the order. We can also provide customer service and process returns for those orders.

Amazon FBA Services and extensions

Seller Amazon Central is Amazon’s sales platform. It offers merchants, so-called “third-party sellers”. The opportunity to provide products for sale domestically and worldwide. Storage and delivery can also be handled via Amazon, and the existing payment options can be used. We introduce you to Amazon FBA programmes and functions.

Amazon PAN EU

PAN-EU FBA enables sellers to deliver their inventory to a local fulfilment centre for Amazon businesses to take care of the logistics. Automatically shipping sellers’ products across its European Fulfilment Network according to the anticipated local customer demand. The product will then be fulfilled from the closest warehouse.

The Pan-European FBA service can also benefit sellers to grow their business by making their products entitled for ‘Amazon Prime’. This means they will have access to millions of Amazon’s most loyal customers, along with Amazon’s trusted and admired customer service.

Fulfillment by Merchant (FBM)

Amazon Fulfiled by Merchant is a fulfilment method in which an Amazon seller is responsible for fulfiling their products purchased on Amazon. FBM can be managed through a seller directly or by partnering with a third-party logistics service provider.

Instead of your products having Prime status and you using either Amazon to handle fulfilment or the Seller Fulfiled Prime program. The merchant is responsible for inventory storage and placement, order fulfilment, returns, and customer service.

Multi-Channel Fulfillment (MCF)

FBA Multi-Channel Fulfillment allows you to combine your online sales channels with Amazon’s fulfillment network and provide fast delivery. Your ecommerce apps, website, and other sales channels while lowering costs and improving customer service with Prime-like delivery speeds. With MCF, you can operate your business using a single inventory source with full shipment tracking.

Seller Fulfilled Prime (SFP)

Amazon Seller-Fulfilled Prime (SFP) is a tempting option that keeps generating interest even though it’s currently a paused program. Getting a Prime badge from Amazon but not dealing with Amazon locations or strict requirements means access to a large pool of shoppers but on your terms. That might be what your company needs to make this year the best so far.

Amazon SFP is a sales tool that gives businesses the “Prime” badge on their products on Amazon’s marketplace. The difference that Amazon SFP offers is that you take orders through Amazon, but you can send these out from a warehouse you or a non-Amazon partner control.

Amazon Global Selling

Amazon’s Global Selling program is designed to help sellers leverage Amazon’s platform and fulfillment network to reach millions of buyers around the world.

Amazon Global Selling is an ecommerce exports program that helps you take your business from India to the global markets in 200+ countries and territories. Whether you are a multi-city store, local seller, upcoming startup or a seasoned exporter, irrespective of your business size, you can export your products and establish your business on the world map.

Central Europe Programme

Central Europe Programme allows you the seller with an ‘Amazon European Marketplaces Account’, and are also registered for ‘Fulfilment by Amazon’ (FBA) to store your inventory in a Germany warehouse, then Amazon handles the distribution to Amazon’s fulfilment centres in Germany, Poland and the Czech Republic at Amazon’s discretion. There are no additional FBA fees to use this service.

The EU Tax Rules for Online Marketplaces

It had been clear for a long time that the rules regarding VAT and ecommerce had been outdated. That is why last summer the EU introduced a new set of tax reforms regarding the collection and calculation of VAT on ecommerce transactions. For online marketplaces, this mean that they were given much more responsibility when it comes to VAT reporting. In many cases, it is now the responsibility of the online marketplace to record and declare the VAT on sales made on their platform.

This change placed a lot more strain on online marketplaces. If they fail to record and report the VAT of the sales made on their platform correctly. They are in danger of receiving fines. This is why we are seeing the introduction of services such as the Amazon VAT service. These services will make it easier for marketplaces to accurately report the VAT that is now their responsibility to declare. This is especially difficult when one considers the varying nature of VAT rates across the EU.

This article will help new businesses using Amazon how to print their invoices for their use. For example, their accountant or person use to track expenses. To send the invoice for the buyer it is usually on request. When the product has been bought by a customer on Amazon an invoice can be requested to whichever customer needed.

If you have got an EU Amazon integration. Amazon will soon require an invoice to be attached to every shipped order in Seller Central. Every order needs to be accompanied by an invoice that Amazon keep hold. Previously this was only a requirement for B2B orders. But now it affects every order you ship.

What is the Amazon VAT Calculation Service (VCS)?

Amazon automates invoice generation using their own service (VCS). The Amazon VAT Calculation Service (VCS) ensures that invoices are generated by sellers within 24 hours of the order being placed. Once they have been generated. The invoices are then available to the buyer, within the Order Information section on Amazon. VAT orders within the EU, using the tax and order information received directly from Amazon.

Go to the Manage Orders tab. You can see all the buyers and their details for every item. You have sold and that they have bought from you. Here you can prepare and send every customer an invoice.

How to print a selected invoice:

Step 1: Go to your Orders in your amazon account. Then select the order that you want the invoice summary of or to print.

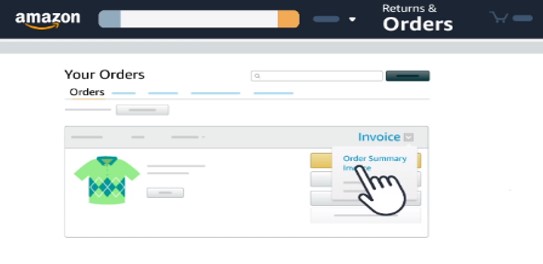

Step 2: Dependent on the buyer/seller that you had placed the order with the following actions can take place:

- Print the invoice

- Or provide an Order summary

Step 3: If the order was placed with a Marketplace seller where the invoice was already issued by Amazon Services Europe Sarl. Or the seller was enrolled with the Amazon Tax Calculation Service then the invoice will be in the Your Orders section.

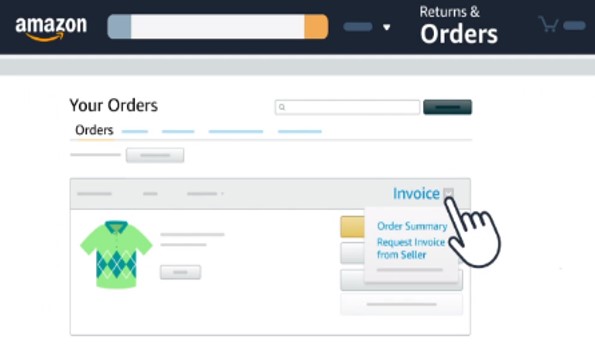

Step 4: Based on the action you want to carry out the option to Print Invoice will appear. Also you can print the Order Summary from here.

Step 5 (If needed): If the invoice did not appear in the Your Orders section you can contact the seller directly and Request Invoice.

Last Note: If a VAT invoice was needed from an order from a Marketplace seller and it doesn’t not appear in the Your Orders section, contact the seller to ask for one.